Parents don't usually think about death, illness, or injury when they are young. As unlikely…

Paying for Long-Term Care

Nearly 70 percent of American retirees will need long-term care in their later years, according to the US Department of Health and Human Services (HHS). The expense of LTC can be astronomical and varies widely by location and by the amount of help a person needs.

According to research from Genworth, the annual costs for long-term care services range from about $55,000 to over $100,000. HHS also reports that those receiving Medicaid-financed nursing home care will spend more time in residence than those who self-finance their care or have private long-term care insurance. These long-term care services and supports (LTSS) are becoming more critical as retirees live longer and worry about outspending their assets.

Affording Long-term Care

Paying for long-term care planning remains a significant challenge for most older Americans, and preparing for service payments can be tricky. LTC insurance may cover a portion of services or all of the payments. However, the person must enroll and pay premiums before the services are needed. The premiums depend on a person’s age, gender, health, location, and other criteria at the time of enrollment. The younger and healthier a person is at enrollment, the less expensive the premiums.

The American Association of Long-Term Care Insurance lists 2022 average premiums for initial benefits of $165,000 (with a 1 to 5 percent annual growth rate) for a healthy fifty-five-year-old male to be between $1,375 to $3,685 per year. For the same coverage type, a healthy fifty-five-year-old woman can expect to pay between $2,150 to $6,400. Premium hikes tend to be costly because metrics used years ago in the insurance industry did not accurately project the real LTSS costs.

What is Hybrid Long-term Care Coverage?

A different payment option is hybrid long-term care coverage. These policies are part annuity or life insurance and part long-term care coverage. You may purchase a policy upfront eliminating any future risk of premium increases, and your heirs may receive a death benefit if you do not need long-term care. This option is an arbitrage approach hoping that you will not require LTSS and that your heirs may benefit. Hybrid policy price comparisons are more difficult to ascertain than a standalone long-term care coverage policy.

How to Utilize a Health Savings Account to Pay for Long-term Care

A third option is for those retirees with sizable health savings accounts to use pre-tax funds to cover long-term care expenses or premiums. Currently, those itemizing deductions can write off long-term care expenses above 7.5 percent of their adjusted gross income on their taxes. Finally, those low-income retirees with assets below a certain threshold may qualify for Medicaid LTSS. Applicants must pass a five-year “look back” period to assure they did not gift or spend down assets to qualify.

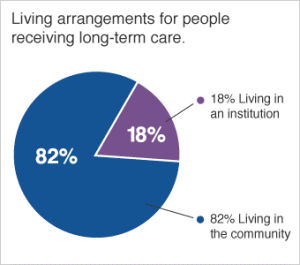

Typically, family members play an important caregiver role for their loved ones who need help with daily living activities. This statement is particularly true in the earlier stages of requiring care, where someone may need help with just one activity of daily living. In-home assistance, community programs, and residential facilities can help your loved one stay as active as possible, accomplishing everyday tasks. The family-style approach constitutes most living arrangements for those who receive long-term care.

Many available resources help older adults continue to reside in their homes and participate in their communities. The stay-at-home option in the earlier stages of a significant long-term need can be the most viable and cost-effective solution. It is also a viable option if the person will not need intensive care for more than a few months. Pivoting to in-home service provision is the most likely scenario for most American retirees. Nursing home residential space is expensive, and Medicaid can only supply so much aid. While most LTSS stays remain paid care and have relatively short durations, the lifetime risk for expensive out-of-pocket costs runs high.

Unfortunately, receiving paid LTSS care is not equally distributed among the US population. Generally, people with limited education and less financial resources are the most likely to experience severe LTSS needs. Over a lifetime, however, the more well-educated population with different socioeconomic advantages tend to live longer and can outlive their assets. Family is an integral part of the solution for long-term care while the federal government responds to the growing need to make this care more available and affordable. For your best outcome, be proactive in your financial planning. Most Americans will need LTSS, so planning accordingly will help improve the quality of care. We would love to help – contact our offices in Midway, Erie, and Franklin PA.

HHS

HHS