Long-term care benefits may be available to you even if you do not meet Medicaid's…

Common Medicare Scams and How to Avoid Them

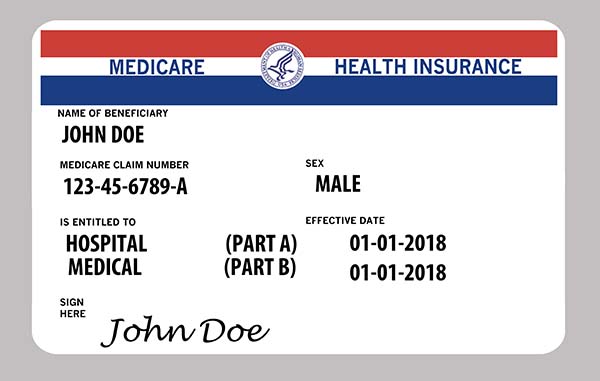

The largest types of insurance fraud by far are scams against government and private health care insurers. Scammers frequently target government insurance like Medicare by stealing newly issued medical ID cards and then stealing identities. The Coalition Against Insurance Fraud estimates that tens of billions of dollars are lost annually to these types of fraud. Additionally, medical identity theft is now a top complaint received by the Federal Trade Commission. Billing fraud is also responsible for huge losses to Medicare funds and is difficult to assess as it can be a billing error or intentional fraud.

How does this affect a senior on an individual level? Scammers typically pose as Medicare officials and ask people to pay for their new cards which in reality are free. Or they phone a potential victim with false news of a refund and ask for the person’s ID number and bank account number to deposit the refund. “Right now … everyone is being inundated with TV commercials, brochures and other official-looking documents in the mail about all the Medicare Advantage plans. It’s so confusing, and in an environment like that, fraud is rampant,” says Micki Nozaki of the California Senior Medicare Patrol. There are more than 50 million Medicare beneficiaries who can annually opt to swap Medicare Advantage and Part D prescription drug plans which provide scammers with the opportunity to prey on vast numbers of seniors.

The Centers for Medicare and Medicaid Services have a list of tips to help prevent fraud. The first and foremost is to protect your Medicare and Social Security numbers vigilantly. It suggests treating your Medicare card like you would a credit card and do not provide the number to anyone other than your doctor, or people you know should have it. Become educated about Medicare with regards to your rights and what a provider can and cannot bill to Medicare. Review your doctor bills carefully, looking for services billed for but not provided to you. Remember that nothing is free with regards to medical care; never accept offers of money or gifts of free services. Be suspicious of your provider if they tell you they know how to “bill Medicare” to pay for a procedure or a service that is not typically covered. Before leaving your pharmacy check to be sure your medication is correct, including the full amount prescribed and whether or not you received a generic or brand name medicine. If your prescription is in error report the problem to the pharmacist before leaving.

Remember Medicare will never visit, call, or email you and ask for personal information such as your Medicare number, Social Security Number, address, or bank account number. Medicare already has this information and does not need you to provide it. Even when Medicare issues new cards that no longer contain your social security number in April of 2019 you will not be required to do anything. You can assume that anyone who claims to be helping you with Medicare and asks for your personal or financial information is a scam artist so close the door, hang up the phone, or delete the email.

When it is time to compare plans be sure to meet with a trustworthy advisor. Some insurance representatives give the industry a bad name by selling you a policy or plan that does not suit your needs or your budget. Some agents go so far as to ask you to sign a release form allowing them to make decisions on your behalf. Never sign anything related to Medicare without first reading it carefully. Additionally, it is a good practice to have a family member or lawyer review the document before signing it. The non-profit National Council on Aging (NCOA) has a free, brief assessment that allows you to compare plans online. You can also contact your local State Health Insurance Assistance Program (SHIP). SHIPs is a provider of free, federally-funded Medicare counseling via a trained volunteer or staff member.

Medicare fraud wastes billions of taxpayer dollars annually. Carefully review your medical bills and have inaccuracies corrected. Guard your personal information vigilantly and be wary of people asking you to provide that information. Meet with a trusted insurance advisor or compare medical plan options using the sites listed above. If you are unsure about something call Medicare directly for clarification.

If you have questions or would like to discuss anything you’ve read, please don’t hesitate to contact us. We would love to help – Contact our offices in Midway, Erie, and Franklin PA.